Fast & Reliable

Tax Services

At Personal Solutions, we take the stress out of tax season with expert, reliable, and personalized solutions. Whether you're an individual, self-employed, or a small business owner, our trusted team is here to maximize your return, ensure compliance, and simplify your finances. Let us ensure you never overpay in taxes.

Our Services

Personal Income Tax Filing

For individuals, families, and freelancers - get the maximum refund you're entitled to

Prior Year & Late Filing

Behind on taxes? No judgement - we'll help you catch up fast

Business Tax Preparation

Custom solutions for LLCs, sole proprietors & corporations

Bookkeeping & Tax Planning

Monthly bookkeeping and strategy to keep your finances in order

IRS Letters & Audit Support

Received a notice? We'll help you respond confidently and correctly

Need something else?

Just ask. We tailor services to your needs

We don't just file your taxes...

We help you understand them

Personal Solutions Tax Services is a trusted, family-owned tax preparation firm proudly serving Fort Worth, Dallas, and the greater DFW area, as well as nationwide. We aim to simplify the tax process from start to finish…Whether you’re filing current-year taxes, catching up on prior-year returns, or responding to IRS letters. Our team is committed to delivering personalized support, maximum refunds, and clear guidance every step of the way.

Whether you prefer virtual or in-person appointments, we’re here to help you find your personal solution.

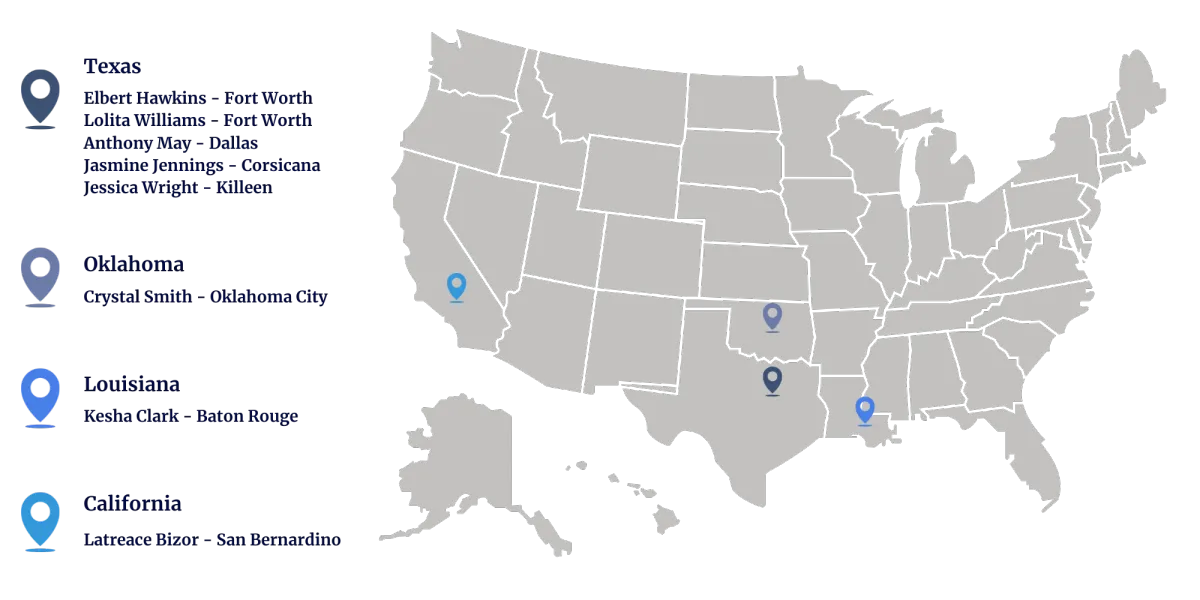

Serving Nation-Wide!

In addition to our Texas office, we also have office space in downtown Oklahoma City and can meet with clients in surrounding cities.

Schedule your appointment at the location that’s most convenient for you!

Continuing to Train and Sharpen Our Skills for the 2025 Tax Season—Dedicated to Delivering Exceptional Tax Preparation Services

We are currently featured on K104 radio broadcasting at 104.5 FM.

Tune In!

STILL NOT SURE?

Frequently Asked Questions

Question 1: What documents do I need to bring?

A valid ID, Social Security cards for you and your dependents, W-2s/1099s, and any deductible-related receipts

Question 2: Can I file for previous years?

Yes! We specialize in prior-year filings and can help you get caught up.

Question 3: Do you offer virtual appointments?

Absolutely - we serve clients across Texas with secure online filing.

Question 4: What if I received a letter from the IRS?

Don't panic - we'll help you review and respond with confidence

Question 5: How long does it take to file?

Most returns are filed within 1-3 business days once we have all your information

Question 6: Do you work with self-employed or 1099 clients?

Yes! We offer specialized support for freelancers, gig workers, and contractors.

TESTIMONIALS

What others are saying

"Super helpful and patient"

"Personal Solutions made tax season painless!"

-Maria R.

"Highly recommend, made filing my taxes easy"

"They caught deductions I didn't even know I qualified for."

- James T.